PURCHASE OF STRATEGIC PLOTS FOR RESIDENTIAL CONSTRUCTION

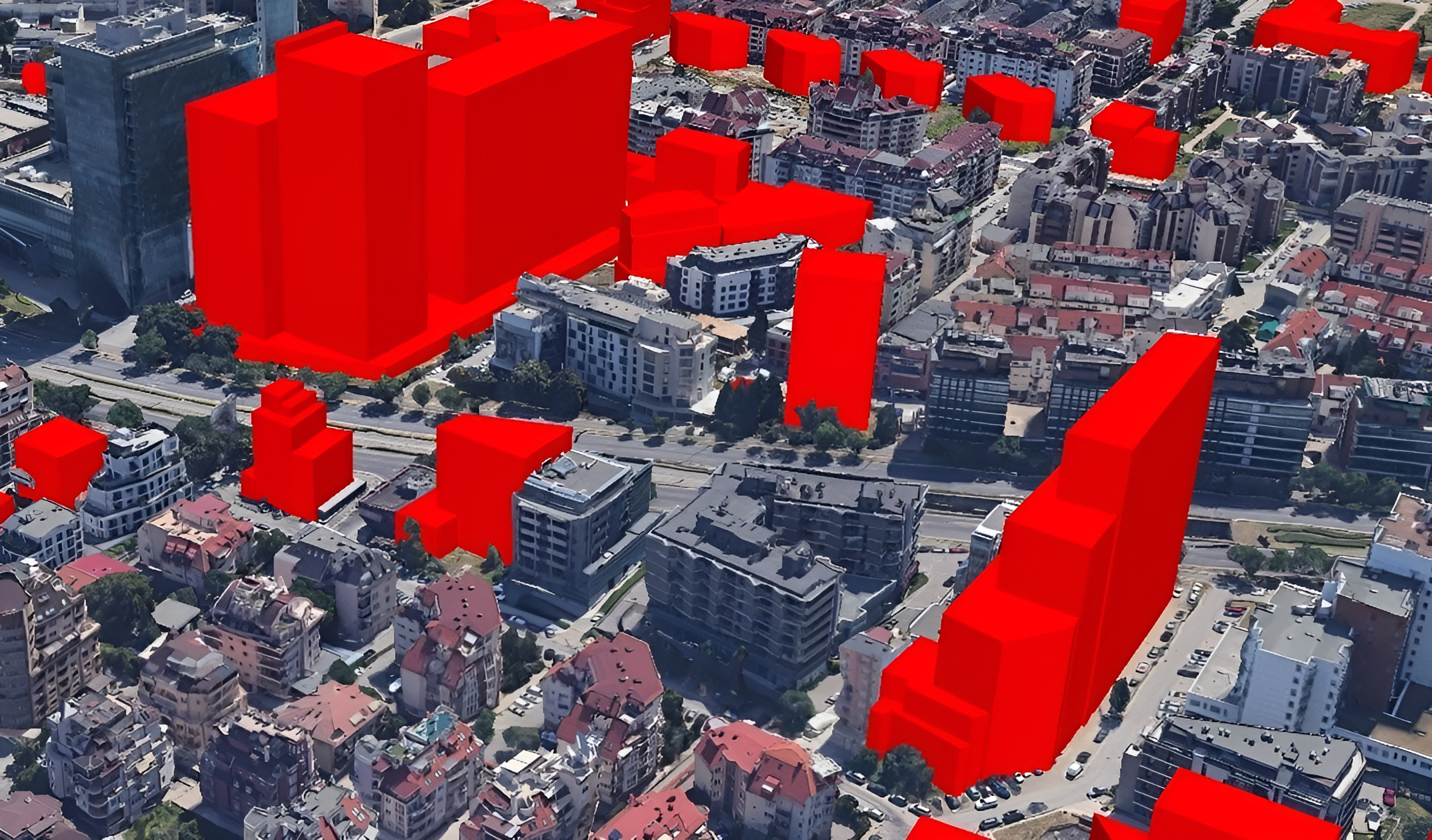

Purchase of strategic plots for residential construction

Basic information about the investment.

1. Type of investment:

- Purchase of strategic plots, with the aim of resale with 200 to over 1000% of their purchase value, after increasing the total allowed building area.

2. Forms of investment:

The investment can be in the form of "Cuentas en Participación" or "Debt Investment", depending on the preferences and risk profile of the investor.

- With "Cuentas en Participación", the investor provides capital to the company in exchange for 30 to 60% from the profit from the successful implementation of the project. This form of investment allows the investor to benefit from the profit generated by the project together with the entrepreneur.

- In "Debt Investment", the investor provides a loan to the company and receives a fixed annual interest of 24 to 36% , which is agreed in advance. This form provides a stable and predictable return without being tied to the success of the project.

3. Minimum amount of investment:

- The minimum amount of investment depends on the available investment opportunities at the time of investing the funds. Typically, minimum participation amounts start at €100,000 , with some projects also offering smaller investments through collective participation.

4. Minimum term of the investment:

- 24 months with the option of exiting the investment through the so-called "substitute party". In this case, the contract is terminated, and the investor receives back the funds paid by him, including a proportional part of the profit or the agreed interest. This part is calculated based on the time during which the funds were used, relative to the total contract period.

5. Minimum guaranteed annual return on investment:

- 24% guaranteed annual return on the invested amount with full capital recovery at the end of the investment period.

How the investment is made: Step by step

1. Identification of strategic parcels

- We look for lots with great development potential that are located in high demand areas or close to key infrastructure projects. The main goal is to find locations where the total permitted building area may be increased.

2. Purchase of the identified plots

- Once we have identified suitable plots, we acquire them at bargain prices, which are often sites that are not yet regulated or have lower buildability indicators.

3. Obtaining permits and increasing the allowable indicators for construction

- After the purchase of the plots, our team of architects and lawyers works for increasing the allowed building indicators , such as height, building density and functional purpose. This process may involve changing development plans or negotiating with local authorities.

4. Increasing the value of the property through infrastructure improvements

- In many cases, after we have increased the parameters for development, we further invest in improving the infrastructure of the plot. This can include building roads, providing access to electricity, water and sewerage, which significantly increases the value of the property.

5. Resale of the plots with a large profit

- After the increase in building indicators and infrastructure improvement, we resell the plots at a profit ranging from 200 to over 1000% of their purchase value. Our clients include construction companies and investors looking for development opportunities in strategic locations.

6. Return of capital and distribution of profit

- After the successful sale of the plots, the investors get back the initial invested funds, together with their shares of the realized profit, which is proportional to their investment.

7. Repeat the process

- After the distribution of the profit, we start a new cycle of buying and increasing the permitted figures for the development of new strategic plots. Investors who wish to continue with us can reinvest their funds in subsequent projects.

This method of strategic investment provides opportunities for profits that cannot be reached through other forms of real estate investment, thanks to the significant increase in the value of plots after changing their development parameters.

Frequently Asked Questions (FAQ)

1. How is it possible to buy a property and resell it for over 1000% profit, is this not a scam?

- This is quite possible and in some cases a common practice, especially when there are major changes in town planning plans. For example, in 2019, the privatization of a plot of land under the former bathhouse "Sitnyakovo" in the capital of Bulgaria - the city of Sofia, which was purchased for BGN 1.5 million by the company "Atama Wellness and Spa". Subsequently, in 2023, a change in the detailed development plan (DSP) of the property was approved, allowing the construction of a 16-story building. After this change, the value of the property jumps to approximately BGN 24 million, resulting in a profit of over BGN 22 million — or over 1,000%. This shows that properly positioned rezoning investments can yield extremely high returns.

Source: fakti.bg

2. How can the total permitted building area on the plot be increased?

- The increase in the area permitted for construction can be achieved by changing the detailed development plan (DSP) of the property, which must be approved by the relevant municipal or state institutions. The process includes rezoning from low-rise to high-rise, negotiations to increase permitted building heights and other adjustments to development plans. Such changes are often approved in mixed-use areas or growing demand for housing where taller or denser buildings can be justified.

3. What are the main risks with this type of investment?

- Key risks include delays in obtaining approvals for zoning changes, regulatory changes that may limit development opportunities, and fluctuations in the real estate market. In case of difficulties with the change of purpose of the property or with the approval of the development, the value of the investment can be withheld.

4. How is the security of my investment guaranteed?

- The security of the investment is guaranteed by a careful analysis of the location, the legal verification of the plot and the possibility of changes in the development plan. Researching local regulatory conditions and town planning is a key factor in ensuring predictability. Also, the support of experienced architects, lawyers and urban planners minimizes risk and increases the probability of successful property development.

5. What does return on investment depend on?

- The return depends primarily on the form of the investment. Investors who choose to invest in the form of "Cuentas en Participación" can expect a percentage of the profit on a successful investment. For those who choose Debt Investment, the annual return is fixed and is based on a pre-agreed interest rate on the capital borrowed.

- The return also depends on the size of the investment. Smaller investments offer a lower rate of return and lower interest, while larger amounts increase the rate of profit and interest. The larger the amount invested, the higher the return will be.

- In addition, the return is also tied to the term of the investment. The longer the investor leaves his funds in the project, the higher the interest and profit he will be able to realize.

6. What happens if you fail to sell the properties?

- In rare cases, if we are unable to sell the properties at the expected price, we will continue to work to find suitable buyers. If this drags on, we can offer various options for exiting the investment, including selling at a lower price or renting out the properties until market conditions improve.

7. Can I exit the investment before the end of the project?

- Investments in this type of project are usually fixed-term. However, in some cases we may offer to buy out your share if there is such demand from other investors or partners. The conditions for this are discussed individually on a case-by-case basis.

8. Which form of investment is for you?

- If you are an investor who is willing to take on higher risk in exchange for the possibility of greater profit, Cuentas en Participación is right for you.

- If you are an investor who prefers minimal risk with predictable and stable returns, Debt Investment is the best solution for you.